26+ Indiana payroll calculator

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only.

Speeding Ticket Cost Calculator In The Us How Much To Pay

Ad Process Payroll Faster Easier With ADP Payroll.

. All Services Backed by Tax Guarantee. No personal information is collected. Ad Process Payroll Faster Easier With ADP Payroll.

As an employer you must match this tax dollar-for. 2 Indiana Salary Paycheck Calculator. 185 rows So the tax year.

Supplemental wages are also taxed at the same rate as regular wages. SUTA runs from 05 and 74. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Here When it Matters Most. The aggregate of Indian state income tax and local tax applicable in a. Indiana Salary Paycheck Calculator.

There are reciprocal agreements for the five states you need to know. Indiana has a flat income tax price meaning youвЂre taxed during the exact exact same 323 price irrespective of your revenue degree or filing status. Customized Payroll Solutions to Suit Your Needs.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Calculating your Indiana state income tax is similar to the steps we listed on our Federal.

Get Started With ADP Payroll. 12 per year while some are paid twice a month on set dates 24 paychecks. Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

All you need to do is. The Indiana Paycheck Calculator will help you determine your paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Our paycheck calculator is a free on-line service and is available to everyone. This tool has been available since 2006 and is visited by over 12000.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Indiana Taxes range from 323 and county taxes range from 05 to 2864. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 185 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

It is not a substitute for the advice of. Free Unbiased Reviews Top Picks. Indiana Hourly Paycheck Calculator.

Ad Compare This Years Top 5 Free Payroll Software. Get Started With ADP Payroll. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Tuesday Tip How To Calculate Your Debt To Income Ratio

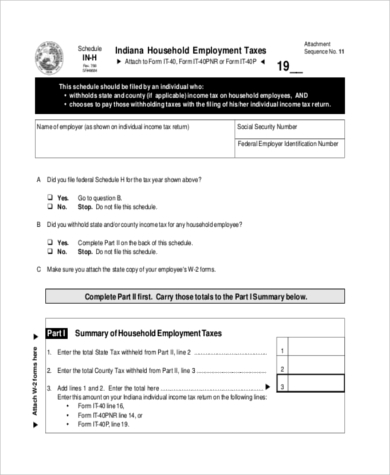

Free 8 Sample Employee Tax Forms In Pdf Ms Word

How Much Is A Speeding Ticket In California Other States

Revenue Share Canzell Careers

California Minimum Wage 2022 Minimum Wage Org

Sales Tax Calculator

Inaccuracies With And S Salary Calculator R Dietetics

Mosaic Apartments 8155 Montage Avenue Avon In Rentcafe

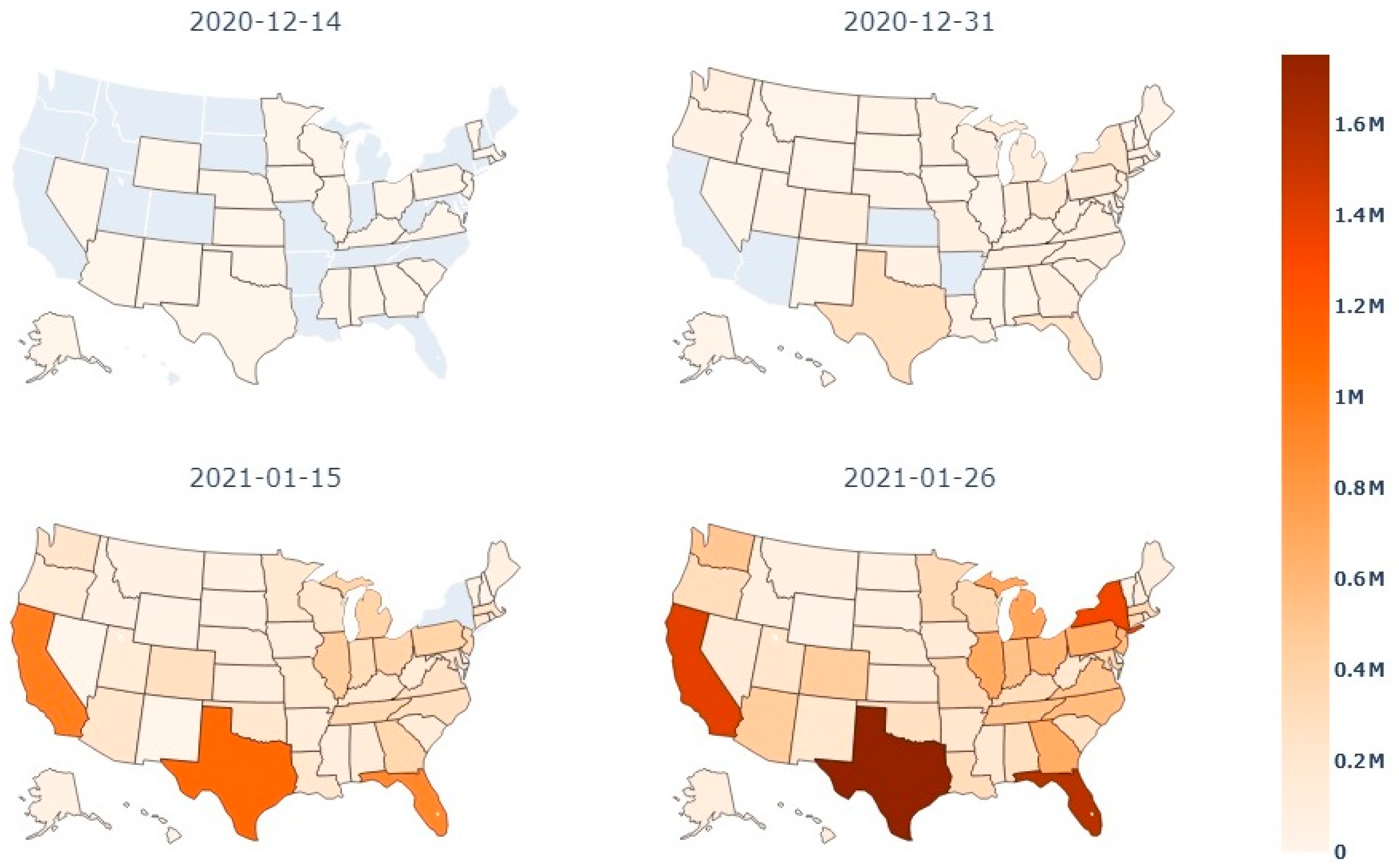

Ijerph Free Full Text Phased Implementation Of Covid 19 Vaccination Rapid Assessment Of Policy Adoption Reach And Effectiveness To Protect The Most Vulnerable In The Us Html

Free 8 Sample Employee Tax Forms In Pdf Ms Word

2

2

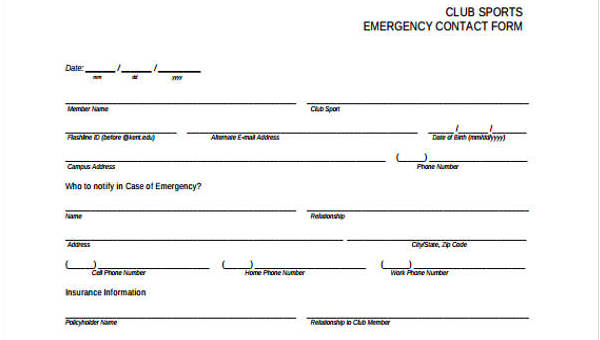

Free 26 Emergency Contact Forms In Pdf

Bradford Place Apartments 3224 S 9th St Lafayette In Rentcafe

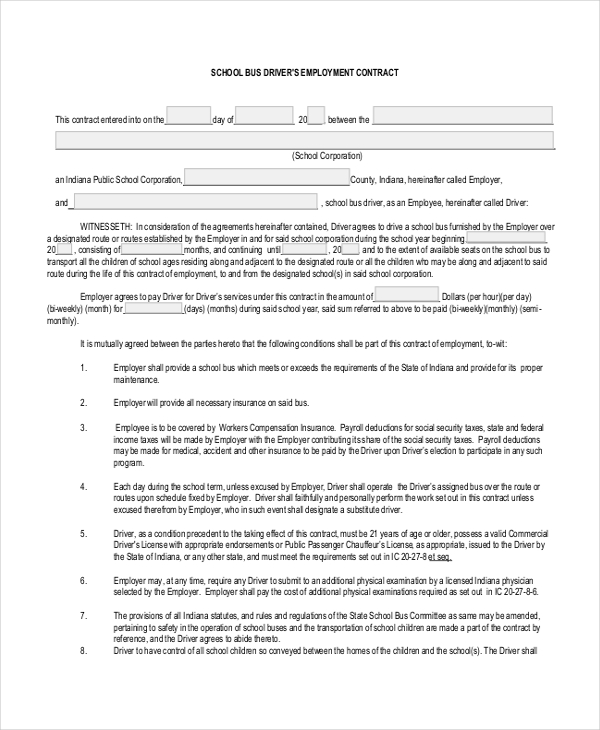

Free 13 Sample Employment Contract Forms In Pdf Ms Word Excel

Netfor Netfor Twitter

Sales Tax Calculator